Gaining confidence with your money is a skill that can be learned, step by step. Today, free resources allow everyone, regardless of their level, to progress and truly enrich their financial literacy.

Understanding how to better manage your finances isn't just for professionals. For everyone, developing a healthy relationship with money starts with reliable, suitable, and free tools.

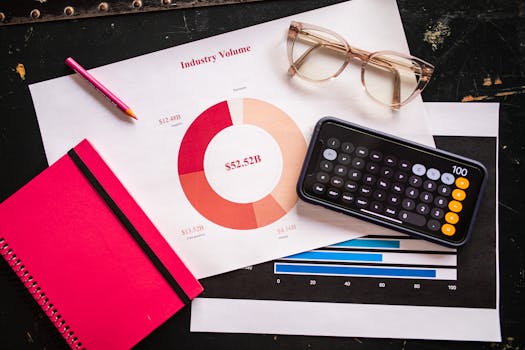

This guide reveals where and how to access quality free resources. Through practical examples, lists, and comparison charts, discover concrete ideas to advance your financial learning.

Explore interactive platforms and personalize your learning

Discovering free resources means accessing interactive online platforms that offer personalized learning paths, dynamic quizzes, and financial simulators tailored to the user.

With these tools, you choose your pace and your priority topics. This teaching is tailored to your needs, like a coach would work with, without being limited to a simple, rigid theory.

Create a customized learning path with financial simulators

You can develop an action plan using budget, loan, or investment simulators. This clarifies each step to take, with concrete scenarios such as: “I want to save 50 euros per month to go on holiday.”

Visualizing the results of financial choices then allows you to correct your strategies over time, just like adjusting a GPS to reach your destination more easily.

The best approach? Regularly test different online simulators, adjust the settings, and note what works for you. Copying and pasting this method immediately solidifies your financial literacy in everyday life.

Using quizzes to reinforce one's understanding of the basics

By opting for free quizzes, you can immediately assess your knowledge and identify areas for improvement. For example, quickly answering questions about the definition of an interest rate helps prepare you for real-life situations during loan negotiations.

Interactive platforms sometimes offer leaderboards, which is a real motivator to improve. It's like solving a puzzle and wanting to move on to the next level by building on your strengths.

Take five minutes each day to review a topic via quiz: “What are the advantages of a regulated savings account?” This will solidify the reflexes you will need when making daily financial choices.

| Platform | Resource type | Recommended level | Next step |

|---|---|---|---|

| Educational banks | Simulator, modules | Beginners to advanced | Create a free account |

| Financial associations | Webinars, FAQs | Beginners | Register for a session |

| Mobile applications | Quizzes, reminders | Beginners to intermediate | Install the application |

| Open Universities | MOOCs, videos | Intermediate | Start a module |

| digital libraries | Ebooks, guides | Beginners | Download a book |

Identify specialized content according to your learning objectives

Targeting your needs allows you to find the best free resources tailored to each topic: budgeting, investing, or debt management. Instead of searching randomly, you follow a guided path.

The key is to ask yourself, “What do I need to answer right now?” Then, select the content that deals exactly with that question, to save time and progress faster.

Choose themed guides and podcasts to target your efforts

Consulting specialized guides or audio series allows you to progress episode by episode: “I want to understand the principle of compound interest, so I download a dedicated podcast.”

Each guide or podcast focuses on a specific problem: saving, credit, major purchases. After listening or reading, apply just one piece of advice the very next day, then observe the results over the following weeks.

- Listening to a financial podcast in the morning to kickstart thinking; this lays the groundwork for taking action during the day.

- Read a step-by-step guide; put each described action into practice, such as opening a savings account from your mobile phone.

- Take quick notes after each episode to record new concepts, then review them every Friday night.

- Download a financial checklist and tick off the measurable boxes as soon as they are achieved. This makes progress tangible.

- Sharing what you have learned with a friend or family member: the explanation consolidates learning and enriches the discussion.

When you follow this routine, free resources become a daily tool and not just a one-off curiosity.

Adapt your research and cross-reference reliable sources

Seeking out video tutorials or articles written by experts increases the credibility of the information. Platforms that cite their sources or display educational certifications are preferred.

Before implementing any advice, review a review or independent opinion. This reduces potential errors and personalizes the decision-making process.

- Identify at least three sources per subject to obtain a complete overview — this limits bias and refines the selection.

- Consult user reviews to spot pitfalls or shortcuts; generally, learning from others' experiences is faster.

- Compare content updates: recently published free resources often reflect current laws or trends.

- Note any contradictions between the different sources, then discuss them with a friend or on a forum; this exchange helps to decide.

- Favoring institutional or associative websites in order to avoid hidden advertising and guarantee neutrality in the approach.

Adopting this rigorous method ensures that each free resource consulted truly builds financial literacy and not false certainties.

Deciphering the mechanisms of saving and testing different strategies

Getting started with saving requires mastering specific mechanisms. Thanks to free resources, you can test strategies while maintaining the security of a simulated environment.

Diversify your media and evaluate the results in real time

Using several simulators available on financial information websites allows you to instantly assess the advantages and limitations of each savings product. Like juggling different investments, this prevents you from "putting all your eggs in one basket."

By taking a few minutes to enter different amounts into each simulator, you can quickly understand the long-term impact of diversification. Try this on Sunday evening to see at a glance which strategy aligns with your goals.

When you get an initial result, revisiting it a week later to adjust the parameters and note any discrepancies helps to ground the experience in concrete facts. This routine encourages you to refine your savings method over time.

Compare regulated and alternative products to adjust your choices

Comparing regulated savings accounts, savings plans, and alternative accounts using a comparison tool is like choosing a pair of shoes based on intended use. The criteria evaluated vary depending on the project: security, return, or availability of funds.

By copying the key information onto a card, it becomes easier to justify a choice to those around you, for example during a family meal. Arguments such as "it's more flexible" or "the rate is guaranteed" then take on their full meaning in real-life discussions.

Keeping the comparative table accessible on your computer or mobile device, and updating it annually, allows you to remain responsive to changes in legislation or financial market developments. This habit makes savings management dynamic and aligned with current events.

Learn about complex financial products through open training courses

Understanding complex financial products is no longer just for specialists. Free MOOCs and educational videos explain the essential mechanisms in short segments, with clear examples tailored to each individual.

Discovering these free resources by theme structures learning: life insurance, ETFs, crypto-assets, everything becomes accessible in a few minutes a day.

Making progress in responsible investing with practical case studies

Exploring online modules on socially responsible investing helps integrate ethical values into decision-making. The exercises simulate portfolio analyses, prompting reflection on "What would I do in this specific situation?"

Copying and pasting a practical guide on ESG indicator assessment makes it easier to compare different funds, making this process accessible even for a novice.

Visualizing the result of one's choices in a tracking table, facilitating subsequent adjustment, reinforces the consistency of the strategy adopted, one step at a time, without rushing.

Deciphering the vocabulary and market scenarios

Illustrated glossaries and expert videos demystify complicated terms: volatility, CAC 40, diversification, etc. This context reassures the user, who feels less lost when faced with discussions about financial markets.

Making a habit of rereading a glossary when you come across a vague term avoids misunderstandings and prepares you more effectively for discussions or appointments with an advisor.

With this background, presenting different scenarios to families or during a simulation creates a training effect that promotes collective progress.

Leveraging free resources to build sustainable financial habits

Using free resources methodically allows you to learn without stress and act with precision, day after day. This guide proves that each tool can be tested, adapted, and adopted at your own pace.

Strengthening one's financial literacy means being open to experimenting with new formats, adjusting one's choices, and sharing discoveries with others. This process is enriched as one multiplies scenarios, tests, and feedback.

At each stage, a simple reflex: identify, compare, apply, and adjust. Adopting this mindset offers the opportunity to progress and acquire solid autonomy, drawing on the vast pool of free resources accessible to all.